Whether you’re on the hunt for a loose diamond, a remarkable engagement or wedding ring, a heartfelt gift, or daily wear jewelry, Blue Nile has a wide array of options to explore.

Are you a diamond aficionado? You’ll be dazzled by their stunning collection, such as this exquisite 1 Carat, VS2, G and Ideal cut diamond.

If Halo rings captivate your heart, their extensive range of over 250 Halo rings will not disappoint, not to forget the hundreds of other jewelry pieces that await your discovery.

TL;DR: Here are a few key points that we discussed in our review:

- Blue Nile has made a significant impact in the online diamond retail landscape, being one of the major players with an expansive inventory of over 200,000 diamonds to cater to a vast spectrum of budget ranges.

- They have recently stepped up their game by providing real 360-degree images of their diamonds, enhancing the online viewing experience to better compete with market leaders.

- The vast array of diamonds may overwhelm some, yet they have striven to ease the selection process.

- Though no longer the largest online diamond retailer, their endeavor to improve customer experience keeps them as a strong contender in the market.

- The Blue Nile Astor collection, while offering superior brilliance, tends to be priced higher, making their regular excellent cut diamonds a more cost-effective choice without compromising on brilliance.

- Blue Nile continues to refine its customer service and digital experience to ensure they remain a compelling choice for diamond enthusiasts, even amidst burgeoning competition.

Let’s start…

Blue Nile Background and Transition to Online Imaging

We’ve been meaning to pen down a comprehensive review about Blue Nile for quite some time, especially given the volume of inquiries we receive concerning this prominent online retailer.

Our journey with Blue Nile dates back over a decade, even before this blog was created. We’ve witnessed significant shifts in their operations over the years, notably their transition to online imaging post-2017.

Prior to 2017, recommending Blue Nile to our readers was a rarity.

The analogy is simple: would you invest in a watch or a car without seeing it? At least some high quality photos?

Similarly, the essence of a diamond’s appeal lies in its visual allure, something that was notably absent from Blue Nile’s offering pre-2017 due to the lack of real images for their diamonds.

And until today, we’re clear that you should NEVER buy a diamond that you can’t visually evaluate, it’s simply a glaring drawback for any store still doing this.

The diamond industry has evolved a lot, and credit here is due, Blue Nile played a huge role in leading this transition & advancement..

A casual stroll into a local Mom-and-Pop jewelry store might present you with dozens of diamond selections. Go to a larger mall store, and a few hundred options await.

Yet, nothing compares to the digital realm, where platforms like Blue Nile and James Allen host an overwhelming collection of over 500,000 diamonds combined!

The inevitable question arises: how do they manage such an expansive inventory?

1. How Blue Nile Operate?

Blue Nile’s distinct business model was conceptualized in 1999 by Mark Vadon to address the demand for a larger, more diverse selection of diamonds.

Unlike traditional brick-and-mortar establishments, Blue Nile operates on a virtual inventory model.

By partnering with large diamond wholesalers, the company lists an extensive array of diamonds on its platform, having an expansive inventory without the overhead costs associated with maintaining a physical inventory.

This unique approach allowed Blue Nile to showcase a seemingly endless array of diamonds, ready for purchase and delivery, at competitive prices compared to traditional jewelers.

As of now, Blue Nile has around 260000 diamonds, if we assume a very -very- rough average cost of each diamond at $3000, we’re talking about $780 million dollars worth of diamonds, can a any store hold that?

2. Blue Nile Pricing Review: A Detailed Look

When Blue Nile started, their prices were unbeatable compared to traditional players in the market like Tiffany & Co, Ritani, and Leibish & Co.

However, with the passage of time and the arrival of robust competitors like James Allen, the price advantage of Blue Nile has become less distinctive.

While Blue Nile still tends to offer lower prices when compared against many traditional retail outlets, the pricing landscape in the online diamond retail sector has become more competitive.

Furthermore, in some cases, especially when comparing specific diamond grades or collections, you may find that other online retailers like Whiteflash’s A CUT ABOVE® might offer better prices or superior quality than Blue Nile’s Astor™ collection.

Therefore, while Blue Nile still holds a price advantage, the gap has narrowed with evolving competition and technological advancements by other players in the market.

The price, although a crucial factor, should not be the only consideration while buying a diamond.

The ability to closely inspect a diamond, understand its inclusions, and get a feel of its overall brilliance and fire is equally important.

When comparing almost identical diamonds from Blue Nile and James Allen, the enhanced viewing technology of James Allen might sway buyers in their favor, despite similar pricing.

In conclusion, while Blue Nile continues to be a competitive option price-wise, the modern diamond buyer might find the visual technology and perhaps, broader pricing options from other online retailers like James Allen or Whiteflash more appealing.

3. Blue Nile Imaging Technology

Blue Nile’s imaging technology took a turn for the better post-2017, following nearly two decades of selling diamonds without images.

The transition was prompted by the influx of tech-savvy competitors in the online diamond retail landscape, making image provision a necessity for maintaining customer trust and competitive edge.

Though not as technologically advanced as the imaging solutions provided by James Allen or Whiteflash, Blue Nile now offers a 360-degree view of selected diamonds, furnishing a reasonable visual insight into the diamond’s appearance. For a comparative understanding, consider these images from James Allen, Blue Nile, and Whiteflash, arranged from left to right respectively:

Links: James Allen diamond, middle is Blue Nile, lastly Whiteflash.

Before 2023, one notable downside with Blue Nile was the insufficient visual representation of their diamond inventory.

Generally, there were at least 50% of their listings without images.

The last time we checked, of the 413k diamonds listed on their platform, a mere 118k diamonds (which is less than 30% of the total inventory) had 360-degree image showcases.

However, this scenario has undergone a transformation. On navigating through Blue Nile’s platform now, you’ll notice the utilization of imaging technology akin to that of James Allen, which seems weird at first glance.

The puzzle pieces fall into place when you discover the underpinning cause—Signet Jewelers, the parent company of James Allen, acquired Blue Nile in late 2022 for a sum of $360 million in a cash transaction.

This acquisition has evidently facilitated the sharing and adoption of James Allen’s superior imaging technology on Blue Nile’s platform, bridging the previous visual representation gap and aligning Blue Nile with one of the industry’s best practices in digital diamond visualization.

The SuperZoom: 40x Magnification

The acquisition has truly been a game changer as it brought James Allen’s superior imaging technology to Blue Nile’s platform.

This transition significantly levels up the online shopping experience for Blue Nile customers, allowing them to enjoy a clearer, more detailed view of the diamonds they are interested in, much like what James Allen had been offering.

With this technological leap, Blue Nile is now in a strong position to compete, providing an enriched and trustworthy buying experience akin to that of its competitors

The SuperZoom feature, encapsulated within the Diamond Display Technology™, stands unparalleled in the domain of imaging technology, delivering a close-up view of diamonds at an astonishing 40x magnification, far outpacing the industry standard.

This image for a diamond from Blue Nile illustrates the remarkable purity achieved with a 20x magnification:

Transitioning to a higher magnification, the following image depicts the same diamond under the 40x SuperZoom feature:

It’s vital to note that this is not merely a closer shot of the 20x image.

Instead, it’s a distinct 360-degree capture at 40x magnification, offering an unparalleled view of the diamond’s features.

4. Blue Nile Extensive Collection and Inventory

Blue Nile’s offerings extend beyond just diamonds and rings. As one of the predominant online diamond retailers, their website boasts an impressive range of products including:

- Colorless & Colored Diamonds

- Earrings

- Pendants

- Astor ™ Collection (elaborated below)

- Rings: spanning Engagement, Wedding, Designer, and Couples rings

- Necklaces

- Bracelets

- Diverse Jewelry options like Birthstone & Designer pieces

- Gemstones

- Lab-created jewelry (excluding loose diamonds) – a recent addition that will be discussed further shortly

One of the notable aspects of Blue Nile is the broad variety encompassed within each collection. It’s not merely about the diverse product categories, but also the multitude of options available within each category that sets them apart.

Inventory Overview

The enormity of Blue Nile’s inventory is a highlight worth mentioning, standing tall when compared to any familiar store.

As of the latest data from October 2021, Blue Nile’s inventory comprises the following:

- Loose Diamonds: An astounding 260k diamonds

- Colored Diamonds: Around 6k

- Rings (engagement & diamond): Approximately 2k styles

- Other Jewelry: +3k pieces

The numbers are quite staggering. For instance, imagine walking into a local jewelry store and being presented with 100 ring styles to choose from.

Blue Nile, on the other hand, offers a whopping 2,000!

Even when you’re sifting through high-grade color options, such as D or E color grades, the collections you’ll encounter on Blue Nile far surpass anything you’d find in a local jewelry store, often not even showcasing 1% of what Blue Nile offers.

In terms of loose diamonds, the closest competitor to Blue Nile’s enormous selection is James Allen.

An intriguing facet of Blue Nile’s vast inventory (which rings true for any large-scale inventory) is the freshness it retains with new diamonds being added daily.

Though these new arrivals may not always fall within your search scope, if time is on your side, it’s worthwhile to keep an eye on these new additions.

Your ideal diamond might just be part of their next batch of exquisite offerings.

5. Blue Nile Dedication to Conflict-Free Diamonds

Ethical practices and responsible sourcing are paramount for Blue Nile. They remain steadfast in ensuring every diamond’s origins are traceable, thus promising their customers that every diamond procured is conflict-free.

This commitment provides customers the confidence and peace of mind, ensuring their purchases aren’t tainted by the weight of blood diamonds.

Blue Nile strictly adheres to global standards including the Kimberley Process and other global regulations. This guarantees every diamond sold by them is verified as conflict-free.

6. Blue Nile Ring Customizer

Blue Nile embraces the idea of creating a personal and unique experience for every customer.

They offer a vast selection of ring settings to cater to a wide range of budgets, starting from an affordable range of around $200, extending to lavish designs that are priced at a whopping $15,000 like this one.

So regardless of the budget in hand, they have a plethora of options tailored for every individual.

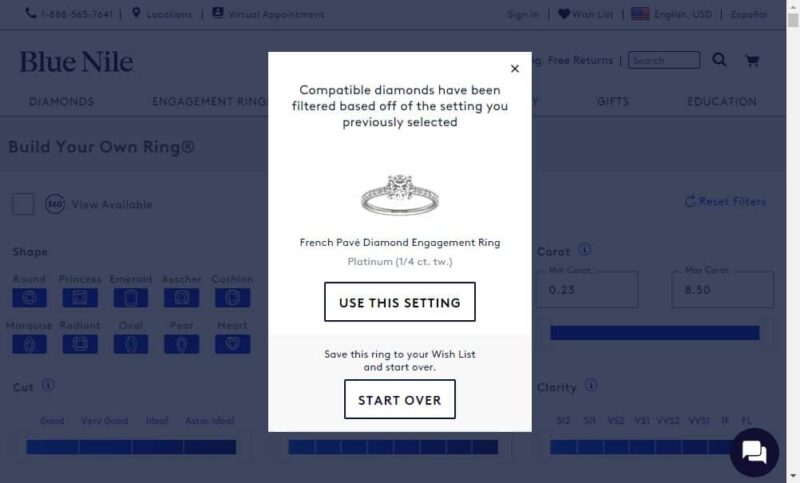

One of the standout features they offer is the intuitive ring customization process.

When you select a particular ring design from their collection and move to choose a diamond, their system thoughtfully filters and recommends diamonds that are a perfect match for your chosen ring setting.

This feature aims to make the process seamless, yet it is flexible, allowing you to either utilize the suggested filter or bypass it, as illustrated here:

Their ring selection interface is finely designed, ensuring a smooth journey from the start to the end of your customization process.

Through this ring customizer, Blue Nile not only provides an easy-to-use platform but also a means to bring your unique vision to life, offering an engaging and personalized ring creation experience.

7. Exploring Blue Nile Website: A Seamless Navigation Experience

Though we have a penchant for the technological prowess and website design of James Allen, it’s only fair to acknowledge that Blue Nile too provides a highly user-friendly online browsing experience.

Right from the get-go, the homepage invites you to dive into your quest—be it in search of a diamond, a ring, or other pieces of jewelry. The well-organized top menu ensures a straightforward path to your desires, making every step of the journey intuitive and hassle-free.

Zooming in on the diamond search aspect, the interface allows you to meticulously filter your choices based on all 4Cs, price, shape (not to be conflated with cut), polish, symmetry, table & depth, among other factors.

The extensive filtering options are designed to steer you effortlessly towards your ideal selection.

8. Blue Nile Astor™ (Previously Signature) Collection

A recurring inquiry we come across is, what exactly is the Astor™ By Blue Nile collection?

Given our extensive discussion on the importance role the cut plays among the 4Cs in determining a diamond’s allure, Blue Nile curated a special collection named Astor, aimed at showcasing diamonds with an extra dash of brilliance and sparkle.

This collection is presented as a higher-quality, more brilliant alternative to other diamonds. Blue Nile claim that the diamonds in the Astor by Blue Nile collection are cut with a particular precision that maximizes sparkle, fire, and brilliance.

We’ve dedicated a complete guide to review Astor by Blue Nile, feel free to check it.

In a previous article where we discussed James Allen’s True Hearts Diamonds, we delved deep into the realm of Hearts & Arrows Diamonds, explaining how their cut sets them apart.

Unlike James Allen, Blue Nile acknowledges the excellent cut of Astor diamonds but stops short of associating them with the Hearts & Arrows distinction.

Notably, both the True Hearts and Astor collections lack specific detailing in their primary certificates (predominantly from GIA).

Are Astor Diamonds Certified as Astor?

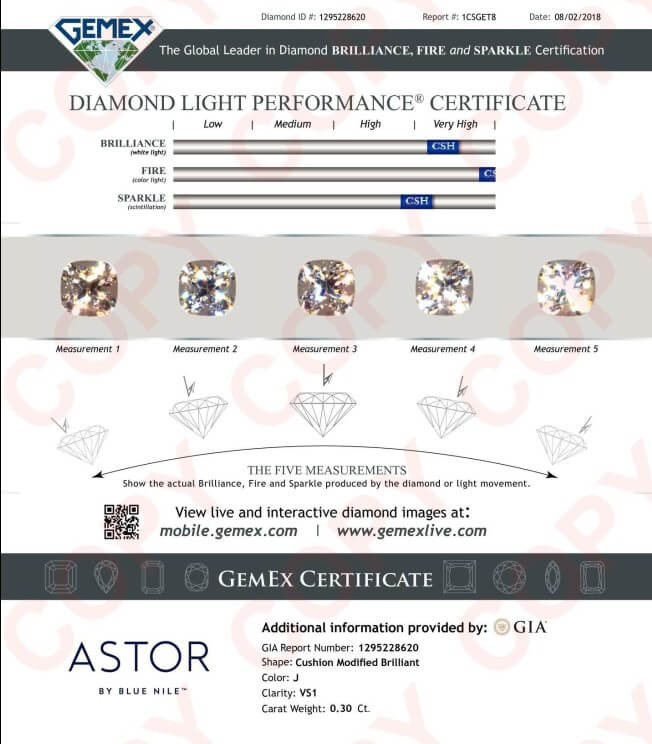

Blue Nile carefully confirms that “Astor by Blue Nile™ diamonds are independently vetted by two industry grading labs (GIA & GemEx), vouching for their supreme quality and exceptional brilliance.”

Quoting them:

Every diamond in The Astor Collection™ is graded for triple excellence in its cut, symmetry and polish by industry experts, including GIA, and GemEx.

This statement somewhat overstates the reality.

In the case of GIA, the affirmation is solely on the excellent cut of Astor diamonds without the specific Astor endorsement. Therefore, you will not find an Astor name, or Hearts & Arrows in a GIA certificate for an Astor diamond.

On the other hand, GemEx does recognizes Astor, as seen in the certificate below, but it’s crucial to know that GemEx doesn’t share the industry-standard repute enjoyed by GIA or AGS.

In a cleverly articulated context, Blue Nile has melded GIA & GemEx together, creating an impression of both labs confirming the Astor distinction in their certificates.

Wrapping up on Astor diamonds, it’s notable that they are available in three distinct shapes: Round, Cushion, and Princess.

9. Blue Nile Rings Designer Collection

For those with a flair for unique, carefully-crafted designs from well-acclaimed designers like Zac Zac, Bella Vaughan, Blue Nile Studio, and The Gallery Collection, the Blue Nile Designer Collection is a haven of elegance.

This collection is thoughtfully curated for individuals looking to articulate their singular style through exquisitely crafted pieces, designs are available for engagement rings, as well as wedding rings.

They currently have more than 150 designs to pick from

This collection offers a smooth path to owning a design marvel, reflecting the hallmark quality and meticulous detailing synonymous with these esteemed designers, all without the need to venture into a retail store.

10. Blue Nile Lab-Grown Diamonds Collections

For a long time, Blue Nile steered clear of venturing into lab-created diamonds, however, discerning the pulse of market demands, they eventually embraced and began proffering lab-grown diamonds.

In a try to meet the increased consumer appetite for both budget-friendly and ethically sourced selections, Blue Nile has augmented their repertoire to encompass premium lab-created diamonds.

These options -with their massive traditional collection- provide consumers a comprehensive range of diamonds that aligns with their personal preferences, budget, and values.

Currently, Blue Nile offers an impressive inventory of over 11,000 lab-created diamonds. The gamut stretches from a humble $300 to a jaw-dropping $153k exquisite 6-carat D color, IF diamond.

11. The Not-so-Tiny Details: Packaging, Payments & Financing

Packaging

The finishing touches often carry as much weight as the technical aspects!

Beyond aesthetically pleasing packaging, the diamond is accompanied by a sizable box, doubling as a refined jewelry box. A cleaning cloth is also included ensuring your diamond remains spellbinding at all times!

Previously, Blue Nile’s packaging left much to be desired, to the point where distinguishing between a diamond box and a rudimentary student’s sharpener was a tad challenging.

However, it’s fair to assert that Blue Nile has significantly refined its packaging over time, showcasing a more polished appearance now.

Payment Methods

For individuals residing outside the US, fluctuating currency rates might prompt a preference for alternative payment channels besides credit cards.

In recognition of this, Blue Nile provides an array of payment options:

1- Bank Wire / International Money Transfer (IMT) / Telegraphic Transfer (TT): You get 1.5% off when you pay through this payment option.

2- Credit Card: They support Visa, MasterCard, China UnionPay wherever they are applicable, and some other cards with some restrictions (AMEX, Discover, Diners Club, JCB), refer here for the terms.

3- PayPal: It can be used for purchases up to $15000 only, and is limited to Orders that don’t use a Gift Certificate as an additional form of payment.

4- For orders shipping to China, AliPay is also a payment option.

Financing Options

Though the advice often leans towards averting a financial albatross as one embarks on life together, everyone’s circumstances are unique.

With this in mind, Blue Nile’s payment/financing arrangements might appeal to some. They extend a credit card facility to finance your ring, segmented into two schemes:

1- No Interest If Paid In Full Within 6, 12, or 18 Months:

For the elongated 18-month tenure, a minimum diamond value of $2000 is stipulated and is exclusive to Astor™ Diamonds, while the 12 months term accommodates any diamond priced above $1500.

2- Equal payments over up to 60 months with 9.99% ARP:

While potentially alluring for pricier diamonds (the 60 months term is tailored for diamonds priced above $6000), this might not resonate with many due to the relatively high APR. It’s plausible your personal card might offer a lower interest rate, thus emerging as a more prudent choice for financing as opposed to Blue Nile’s scheme.

It’s pivotal to note that this card program is confined to residents of the United States, Puerto Rico, Guam, US Virgin Islands, and Northern Mariana Islands, and is applicable solely for transactions in US dollars.

For an exhaustive elucidation of the terms & conditions governing Blue Nile Financing options, check this page.

12. Diamond Price Match Guarantee

Blue Nile’s Price Match Guarantee ensures customers receive the best price on a specific diamond.

If a you find an identical diamond at a lower price elsewhere, Blue Nile will match that price, given the diamonds are identical in attributes like Carat weight, cut, color, and clarity, among others, with the GIA certificate and publicly listed price of the competing diamond provided.

This program is for prospective purchases only, not post-purchase, though there’s a 30-day return provision.

Blue Nile Review Summary

Blue Nile, a trailblazer in the online diamond retail sector, has consistently evolved to maintain a competitive stance amidst rising competitors like James Allen.

Their recent integration of real 360-degree imagery for diamonds significantly bolstered their market standing, echoing their commitment to customer-centric advancements

They finally joined the movement for lab-created diamonds, and now offers thousands of these diamonds with HD images.

The platform offers user-friendly navigation, a customizable ring selection experience, and a distinct Designer Collection featuring renowned designers.

Blue Nile’s Astor collection, although boasting superior brilliance, often comes with a heftier price tag, rendering their regular excellent cut diamonds as a more cost-effective yet brilliant choice.

For further details, you can check our James Allen Vs. Blue Nile Comparison & Review, and if you still have any questions, please don’t hesitate to reach out and drop us a comment or send a message, and we will be glad to help.

Still not sure where to buy your diamond?

We always recommend shopping diamonds online and created a Full guide to shop diamonds like a Pro.

Among online retailers, here are our favorite stores click their logo to visit store

-

James Allen:

Our favorite online store, best diamond imaging technology available today, comes with the largest collection with more than half a million loose diamonds.

-

Blue Nile:

Widest collection of loose diamonds of all sizes, great imaging technology for most of their inventory (hundreds of thousands of diamonds), great customer support.

-

Whiteflash:

Home Of A CUT ABOVE® Super Ideal Diamonds, they stand out from the crowd by offering premium diamonds cuts, tailored to those who love the details, at great prices too.